Use digital transformation to improve your accounts department!

Empower your AP team with Dajon’s automation solutions

Your accounting department is one of your organisation’s most document and data-rich environments. Without efficient processes in place, it can also become one of the most costly departments, in time, money and resources. This is where our accounts payable automation solutions can assist you and your team by making sense of invoices, compliance, and more.

Accounts Payable (AP) Automation

From invoice and purchase order processing to data entry, reduce risk and regain full control of your accounting processes with AP automation. By managing the way work gets done, AP automation enables information to be error-free, digitised, findable and readily available, therefore freeing up your accounting team to focus on their key deliverables and improve service levels.

With our AP automation solutions; all processes are centrally managed, allowing you to easily adapt the way you work to address threats or opportunities without any additional training or dependency on internal IT. No matter how many invoices your organisation handles, Dajon can help you to reduce the time your processes take, reduce costs and ultimately support you in the growth of your business.

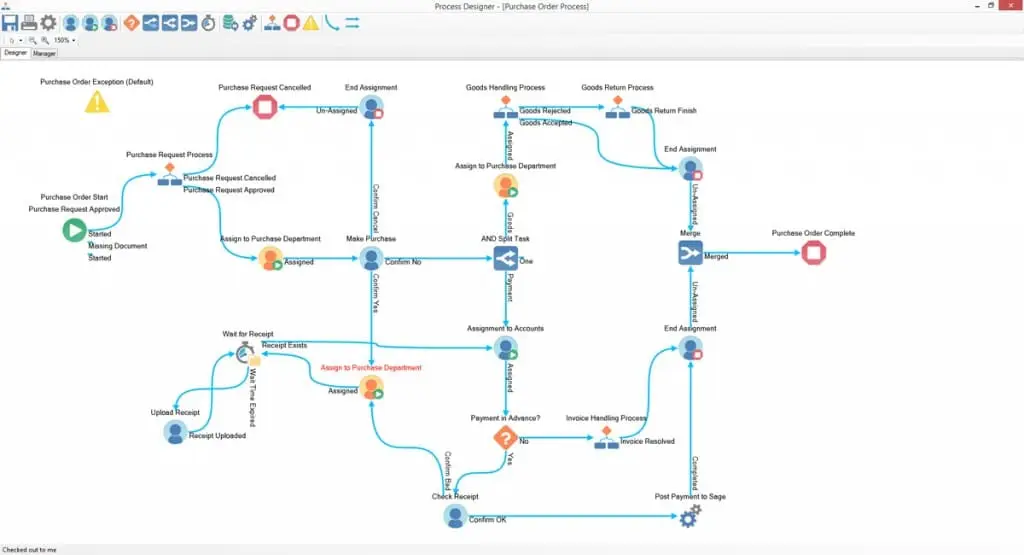

Business Process Designer

Our AP Automation has a native drag-and-drop business process designer which allows you to determine how work is done. Once finalised, a set of web browser applications are then deployed which control how the work is carried out.

Task Router

Since it has been predetermined how work gets done, AP Automation knows how to assign work downstream and tasks will not be assigned until all the information needed is available, a task will then be presented to the right person.

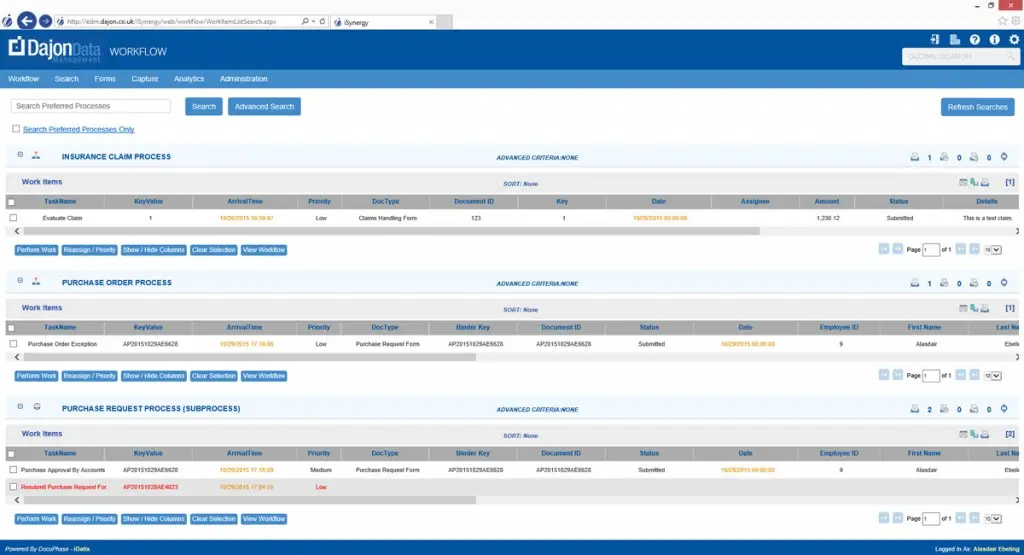

Intuitive Work Queue

Each worker is presented with a work queue which will prioritise work depending on criticality. Quick searches are available and management has a direct summary and detailed view of how work is getting done and where bottlenecks are occurring.

Frequently Asked Questions

- Is AP automation worth it?Yes, AP automation is worth the investment for most businesses. The traditional accounts payable process is often time-consuming and error-prone, involving manual data entry, paper invoices, and a series of approval steps that can create bottlenecks. AP automation streamlines these processes by digitising and automating invoice capture, data entry, and approval workflows. This not only reduces the time and effort required but also minimises errors and the risk of fraud. Additionally, AP automation provides better visibility and control over cash flow, allowing businesses to take advantage of early payment discounts and avoid late payment penalties. The return on investment (ROI) from these efficiencies often justifies the initial costs of implementing AP automation.

- Can you automate accounts payable?Absolutely, accounts payable can be automated. AP automation solutions leverage technologies such as optical character recognition (OCR), artificial intelligence (AI), and machine learning to automate the capture and processing of invoices. These systems can extract data from invoices, match it with purchase orders and receipts, and route it through predefined approval workflows. Integration with enterprise resource planning (ERP) systems ensures that all relevant data is seamlessly transferred and updated, further reducing manual intervention. By automating these tasks, companies can significantly reduce the time and resources spent on AP processes, allowing the finance team to focus on more strategic activities.

- What is AP process automation?AP process automation refers to the use of technology to streamline and enhance the efficiency of accounts payable operations. It involves automating various steps in the AP workflow, including invoice receipt, data capture, validation, approval, and payment processing. AP automation solutions typically use OCR to digitise paper invoices, extract relevant data, and automatically enter it into the system. AI and machine learning algorithms can then validate the data against purchase orders and receipts, flagging any discrepancies for review. Automated workflows route invoices to the appropriate approvers, reducing delays and ensuring timely payments. Finally, these systems can generate and execute payment instructions, completing the AP cycle with minimal human intervention.

- How will AP automation benefit me?AP automation offers numerous benefits that can significantly improve your business operations. Firstly, it enhances efficiency by reducing manual tasks and accelerating the invoice processing cycle. This leads to faster approval times and ensures that suppliers are paid on time, strengthening vendor relationships. Secondly, it improves accuracy by minimising human errors associated with manual data entry. Automated systems can also detect and prevent duplicate payments and fraud, enhancing financial control and compliance. Thirdly, AP automation provides better visibility and reporting capabilities. With real-time access to invoice and payment data, businesses can monitor cash flow, manage working capital more effectively, and make informed financial decisions. Lastly, the cost savings from reduced labour, paper, and storage expenses, combined with potential early payment discounts, contribute to a strong ROI.